5 common investment mistakes

1. Not setting an investment objective

A large number of investors are habituated to carrying out their investment activity in a haphazard and sporadic manner. Very often they fail to set an investment objective which is a basic tenet of financial planning. Investors should adopt a more systematic approach to investing by creating distinct portfolios for all their needs i.e. short-term (planning for a vacation), medium-term (buying a car) and long-term (planning for retirement) needs respectively. Setting of investment objectives also incorporates a degree of discipline which is a vital ingredient for the success of any the investment activity.

2. Not doing your homework

Investing like any other serious activity needs a fair degree of preparation at the investors’ end. Investors need to gather information and acquaint themselves with all the options available to them. Investing in a given asset class (for example fixed deposits) simply because you have conventionally done so is inappropriate. Investors have a plethora of options ranging from mutual funds, fixed deposits, and bonds to small savings schemes to choose from. After getting the facts in place, investors should select instruments that are best equipped to fulfill their investment objectives.

3. Succumbing to the “noise”

Every time the equity markets hit a purple patch, investors come face-to-face with a lot of “noise”. Fund houses go on an IPO (Initial Public Offering) launch spree and distributors do their bit by convincing investors that the recently lunched scheme is the place to be. For example recent times have seen a surge in interest in funds of the flexi cap and mid cap variety. Investors tend to succumb to the noise and get invested simply because everyone else is doing so. The trouble is that investors could discard their pre-determined asset allocation and make investments contrary to their risk appetite.Investors must exercise a lot of discretion and resist falling prey to the herd mentality, especially at a time when everyone around them is busy painting a rosy picture of the investment scenario.

4. Getting attached to investments

Investors must remember at all times that investments are a means to achieve ends (financial goals) and not goals by themselves. If investments have failed to perform their requisite task, then investors should be flexible enough to act on the same. Investors should never get attached to their investments and stubbornly cling on to them. Assess at regular intervals how well your investments have performed and initiate the necessary corrective measures.

5. Timing the markets

A large number of investors like to believe that they can time the markets; nothing could be farther from the truth. If this notion was correct, we would have experienced a surfeit of fund managers and investment gurus. Instead of trying to outsmart the markets and failing in the process, adopt a more scientific approach. Use the SIP (Systematic Investment Plan) route and invest regularly to benefit from the markets.

Don’t try to beat the markets, join them instead.

Ultra mega power projects (UMPP) under way

Lanco Infratech and Tata Power emerged as lowest bidders for the first two UMPPs

The bids for two ultra mega power projects (UMPPs) atSasan and Mundra were opened today. A total of 16 bidswere received for the two projects. Ten companies had bidfor the Sasan project, which will be based on pithead coal, and six had bid for the Mundra project, which will be basedon imported coal. The investment per project will be in therange of Rs 16,000 - 20,000 crore.

The companies in the race for constructing India's largestpower plants of 4,000 MW of capacity each were Tata Power, Larsen and Toubro, Reliance Energy, Essar Power and SterliteIndustries. All these companies had bid for both the projects.

The other bidders for the Sasan project were National Thermal Power Corporation (NTPC), Torrent Power, Jindal Steel & Power, Jaiprakash Associates and Lanco Infratech (with British partner - Globeleq). The only other company that had bid for the Mundra project was Adani Enterprises.

And the winners are... Hyderabad-based Lanco Infratech, in association with theSingapore-based Globeleq, has won the bid for the country'sfirst UMPP coming up at Sasan in Madhya Pradesh.

Recommended Stock - Tata Elxsi

Recommendation: BUY

Price target: Rs 320

Current market price: Rs 232

Key points

- Niche player with distinct competitive strengths: Tata Elxsi Ltd (TEL) has built the required scale of operations and established strong client relationships with leading global companies to effectively tap the huge opportunity emerging in the niche segment of product design and engineering space.

- In this space, the size of the opportunity for the domestic companies is estimated to more than double to $6.6 billion by 2010.

- TEL also has the advantage of having developed reusable components (intellectual property to provide faster and more valuable proposition to the customers) and is investing to boost its delivery capabilities in the high-end services like VLSI and chip design.

- Aggressive expansion plans: TEL has aggressive expansion plans in terms of the capital expenditure on physical infrastructure and employee addition. This clearly reflects the management's growing confidence in the revenue growth visibility over the next few years.

- Improving margins: The shift in the revenue mix in favour of the high-margin software development service business has significantly improved the company's operating margins in the past two years (up by 490 basis points to 19.8% in FY2006).

- The trend is expected to continue and further boost margins by 250 basis points during FY2006-08, in spite of the aggressive expansion plans and rising wage inflation.

- Attractive valuations and decent dividend yield: Revenues and earnings are estimated to grow at a robust rate of 26.8% and 34.5% respectively, during the period FY2006-08.

- Moreover, the company offers a decent dividend yield of 2.8% (based on the 65% dividend given in FY2006), which is likely to limit the downside risk.

I recommend a BUY call on TEL with a one-year target price of Rs 320.

Recommended Stock - Fem Care Pharma

Recommendation: BUY

Price target: Rs 500

Current market price: Rs 358

Key points

- Leadership position in a niche category: Fem Care Pharma Ltd (FCPL) has a dominant market share (around 65%) in the niche segment of bleach cream. It is also among the leading players in the liquid soap and hair-removing categories.

- To boost its overall growth, the company has introduced several product variants at various price points to effectively tap the expected growth in the FMCG industry, especially the fast growing beauty treatment and skin care segments.

- Incremental growth from exports: In FY2006, FCPL acquired a US-registered premium bleaching cream brand, Jaquline, which has an established presence in the UAE and Middle-East markets.

- The company plans to utilise it as an umbrella brand to introduce skin care and beauty products, and boost the overall growth of its export business.

- Margins to firm up: The introduction of high-margin premium products has positively affected its operating margins. The company has also commissioned a new manufacturing facility in the tax-blessed region of Baddi, Himachal Pradesh.

- The fiscal incentives in the form of income tax and excise duty exemptions are further boosting its overall profitability.

- Consolidation of its marketing arm: The distribution of FCPL's products is done exclusively by its 60% subsidiary, Mirasu Marketing.

- FCPL is expected to acquire the remaining 40% stake (held directly by the promoters) in Mirasu Marketing over the next one year. The consolidation is likely to result in marginal dilution in its equity base (about 1-1.5% on the higher side) but would be earnings accretive.

- Attractive valuation: The consolidated revenues and earnings are estimated to grow at a CAGR of 17.5% and 48.3% respectively during FY2006-08. Currently the stock trades at 9.9x FY2007E and 8x FY2008E earnings.

- I recommend a BUY on FCPL with a price target of Rs 500.

11,500 ain’t good enough: Experts

Hemen Kapadia, Director of Morpheus Inc, has warned that though retail investors have made a comeback, they should be wary of investing in the markets. “There has certainly been some momentum in the MidCap segment in the last few days, but there are a lot of areas for concern,” Kapadia said.He added that, though crude oil prices have come down, they are still hovering above $73. “Also, the FII (foreign institutional investors) outlook for India is still negative. The only thing positive right now is the long-term outlook. But I cannot stress enough that investors need to be careful,” he told Mumbai Mirror.

Anil Mascarenhas, Editor of IndiaInfoline.com, felt that the markets are at a stage that’s mostly operator-driven. “Retail investors were waiting for the markets to gain some momentum, but we expect some amount of correction at these levels,” he explained, adding that there may be a huge downward swing in case the markets come down.

As a result, Mascarenhas said, investors should be aware of asset allocation. “A certain part should be kept in fixed sources like banks and debt. When the Sensex comes down, then the funds could be transferred to the equity markets. This way, valuations would be more attractive,” Anil said.

Dr V V L N Shastry, Chief Financial Officer of the Firstcall Equity Services, pointed out that the upside of the Sensex’s current level is that it may touch 11900 to 12000 level. “The reason for the upward swing is the anticipation that the US Federal Reserve may not hike interest rates in the near future. But the markets may correct at every level,” he said.

As for Hemen Kapadia, he advises investors to wait for the sub-10,000 level and invest only then. “They have to take a call and book profits at higher levels,” he said.

• “There are a lot of areas for concern” – Hemen Kapadia, Morpheus Inc

Nervousness may persist

Concerns of rising infation spooked the US markets on Tuesday, with the Dow Jones registering its seventh loss in the last eight sessions at 10706, down 86 points, while the Nasdaq declining by 19 points to close at 2072.

Sharp fall in the domestic market weighed heavily on the Indian floats trading on the US bourses. Rediff was the major loser and tanked over 8% while VSNL, MTNL, Wipro, Dr Reddy's, Tata Motors and Patni Computers slumped over 2-5% each. Infosys, Satyam and HDFC Bank ended with losses of over 1% each.

International crude oil prices slipped below $70 mark, with the Nymex light crude oil for July delivery sliding by $1.80 to close at $68.56 per barrel. In the commodity space, the Comex gold for August series plummeted $44.30 to settle at $567 a troy ounce.

Stocks to watch

Tata Steel is considering a proposal to bid for a majority stake in South African firm Highveld Steel and Vanadium Corporation's steel and vanadium businesses.

Tata Motors has received an order worth Rs55 crore from the Congo for revamping the urban transport system of Kinshasa.

Reliance Communications has earmarked around Rs2,500 crore for its GSM foray into new circles.

Hot Picks - Bajaj Auto

CMP = Rs 2,718

Price Target = Rs 3,500

- With the help of new product launches over the last few years, Bajaj Auto Ltd (BAL) is well poised to take advantage of the secular growth in the two-wheeler market. BAL is likely to consolidate its position in the market further as the new product launches continue.

- The three-wheeler segment, which is a high-margin business, is turning around after a brief lull. The changes in the regulatory regime in favour of vehicles using cleaner fuel is likely to boost the demand for threewheelers where BAL is the undisputed leader.

- With the increased contribution of high-margin vehicles and the softening of the prices of steel, BAL is expected to see a 23% compounded annual growth in its earnings over FY2006-08E.

- The stock is currently quoting at a PER of 16.1x its FY2008E earnings. The investment on the company.s books (Rs 648 per share) and the insurance subsidiaries (Rs920 per share) add substantial value to BAL.s fair value.

Stock Recommendations for this week

Recommendation: Buy

CMP = Rs 283

Price target: Rs 340

- In a recent development, the energy division of Thermax Ltd has bagged three orders, details of which are given below.

- 2 x 25 megawatt (MW) cogeneration plant from a PVC and caustic soda manufacturer in Tamil Nadu. The value of the order is Rs140 crore.

- 1 x 40MW IPP being developed by a leading power utility company from Kolkata. The value of the order is approximately Rs150 crore.

- A repeat order from a leading cement manufacturer in south India for a unit of 18MW to be set up in Andhra Pradesh valued at approximately Rs55 crore.

- The above three orders are valued at Rs345 crore. These are large ticket orders, which in effect are accelerating the growth momentum in the company’s order book. Earlier the energy division of Thermax had bagged the single largest order valued at about Rs360 crore from Reliance Industries for their new refinery project.

- This order was for the design, manufacture, supply, erection and commissioning of auxiliary boilers and a heat recovery stem generator (HRSG).

Stock Recommendation for this volatile season...

Recommendation: Buy

CMP = Rs 97

Price target: Rs 140

- Welspun India Ltd (WIL) has reported a profit after tax (PAT) of Rs10.71 crore for Q4FY2006 and Rs41.55 crore for FY2006. The earnings per share for Q4FY2006 stood at Rs1.35 and that for FY2006 at Rs5.35.

- The sales grew by 38.9% from Rs147.61 crore in Q4FY2005 to Rs205.10 crore in Q4FY2006. The exports grew by 37.5% from Rs135.59 crore in Q4FY2005 to Rs186.41 crore in Q4FY2006.

- The operating profit grew at a lower pace of 20.4% from Rs26.11 crore in Q4FY2005 to Rs31.42 crore in Q4FY2006 mainly on account of the increased staff cost and other expenditure. The PAT stood at Rs10.71 crore in Q4FY2006 as against Rs10.17 crore in Q4FY2005, a growth of merely 5.1% on account of the higher depreciation and interest cost.

- WIL's net sales have grown by 37.2% from Rs476.31 crore in FY2005 to Rs653.73 crore in FY2006, led by a 37.5% growth in exports. However, the PAT growth was muted at 7.7% year on year (yoy) for FY2006 and the same stood at Rs41.55 crore in FY2006 as against Rs38.58 crore in FY2005.

- WIL spent Rs575 crore for capital expenditure (capex) for the phase I of its expansion, which has already gone on stream and the benefits of of the same will be reflected in FY2007. WIL has lined up a capex of Rs650 crore for phase II, most of which would be completed by Q4FY2007.

- WIL will be a key beneficiary of the growth in the home textiles exports as its product offerings will include terry towels where it is a leading player as well as bed linen and decorative linen items, making it a complete home textiles shop.

- I expect WIL's revenues to grow at a compounded annual growth rate (CAGR) of 48% over FY2006-08 and the earnings to grow at a CAGR of 52% over the same period from Rs41.2 crore in FY2006 to Rs95.9 crore in FY2008.

- At the current market price of Rs97, WIL is trading at 7.7x its FY2008E earnings and 6.7x its FY2008E enterprise value (EV)/earnings before interest, depreciation, tax and amortisation (EBIDTA). I maintain a Buy on WIL with a price target of Rs140.

Stock Recommendations in this volatile market

Recommendation: Buy

CMP = Rs 82

Price target: Rs178

- Omax Auto's Q4FY2006 net sales were flat at Rs142 crore. The earnings before interest, depreciation, tax and amortisation (EBIDTA) margin for the quarter declined by 230 basis points to 8.1% mainly due to an increase in the employee and fuel costs. The profit after tax (PAT) for the quarter is down by 7% to Rs4.95 crore.

- For the full year, the sales have registered a growth of 9.2% to Rs578 crore. Exports for FY2006 were at Rs27 crore as compared with Rs15 crore in the previous year.

- The operating profit for the year rose marginally by 1% to Rs49.8 crore, as the operating profit margin (OPM) declined from 9.3% to 8.6%. The net profit for the year was flat at Rs20.04 crore as compared with Rs20.29 crore in FY2005.

- The company is aiming to double its exports in the next two years. The domestic operations are expected to recover with the stabilisation and improvement of the performance of its Bangalore and Binola plants.

- The earnings estimate for FY2007 is upgraded by 6.4% to Rs14.9 and introducing our earnings estimate for FY2008 at Rs20.8.

- At the current market price of Rs82, the stock trades at 4.1x its FY2008E earnings. I maintain Buy call on the stock with a price target of Rs178.

Recommendation: Buy

CMP = Rs 982

Price target: Rs 1,130

- Lupin to market Cefdinir suspensions

- Lupin has announced that the US Food and Drug Administration (US FDA) has approved the company's abbreviated new drug application (ANDA) for Cefdinir suspension 125mg/5ml.

It's a good time to buy blue chips

Heavyweights which saw increased buying include Reliance Industries, which surged 4% to end at Rs 969.10, with volumes totalling 3.26m shares on the BSE alone. Diversified company and Aditya Birla flagship, Grasim Industries, also saw renewed interest with the stock jumping by an unprecedented 9% to Rs 1,916.70, with over 62,432 shares changing hands on the BSE.

“Smart guys are buying as Monday’s fall has presented a major opportunity,” said Arpit Agarwal, CEO of Dawnay Day AV, a unit of UK-based financial services major Dawnay Day, adding that many foreign funds have started buying “in a big way.” Indian equities had fallen by an average of 15% after reaching a high on May 11, when the index crossed the 12,600 levels.

Heavyweights which saw increased buying include Reliance Industries, which surged 4% to end at Rs 969.10, with volumes totalling 3.26m shares on the BSE alone. Diversified company and Aditya Birla flagship, Grasim Industries, also saw renewed interest with the stock jumping by an unprecedented 9% to Rs 1,916.70, with over 62,432 shares changing hands on the BSE. In the futures and options segment, market participants said that the situation had improved. “The panic which was there yesterday, was absent today with moderate rollovers,” said Rahul Rege, senior vice-president at Sharekhan. “Typically, the rollovers are about 40%; today they were about 25%,” he added.

Rollovers in the F&O segment implies closing out position in the current-month futures contract and taking a fresh position on the next-month futures contracts. The May futures contract expires on May 25. “The worst is over...and the biggest reason is because NSE is not pressing the panic button,” said Dimensional Securities MD Ajit Surana. “There were fears about payment crisis, but after the banks assured help, concerns about liquidity have gone.” Trading sentiment improved after the NSE clarified that there were no payments crisis.

But traders said that the trends in the coming days are not strong as most investors are still wary of higher levels. The fears come even as the OECD painted a grim economic outlook. In its recent report, the OECD said that India’s growth could slow to 7% next year, from the current 7.5% due to tight monetary and fiscal policy measures that will restrict investments. There was mixed sentiment among key markets overseas, with Hong Kong’s Hang Seng index rising 0.43%, while Japan’s Nikkei was down 1.63%. Singapore’s Straits Times Index was up 0.5%, while the Jakarta Composite Index rose 1.3%.

Why should we welcome the stock market crash

Economics assumes that human beings are rational. But human reactions to stock market movements are utterly irrational. When markets rise, everybody cheers. When markets crash — as has been the case for two weeks — everybody moans. A hunt for culprits often ensues. No such hunt is ever announced when the markets are rising. In past scams, when manipulators like Harshad Mehta and Ketan Parekh sent share prices through the roof, they were hailed as geniuses and became celebrities. Some market experts cautioned that the markets had shot up to insane levels. But this plea for sanity was widely dismissed as stupid, and ordinary housewives and college kids bought frenziedly in the belief that share prices could only go up.

However, when the markets inevitably fell, the hero-manipulators were suddenly denounced as villains. They were accused of the dreadful sin of rigging markets, and thus misleading small investors. Ironically, no investor complained as long as the manipulators rigged prices upward. The complaints began only when the manipulators were unable to rig markets any more, and prices crashed. Truth be told, the real public complaint against Harshad Mehta and Ketan Parekh was not that they manipulated prices upward, but that they failed to manipulate it upward forever.

For that, this could not be forgiven. The underlying assumption of small investors is that share prices should rise forever. Now, if the price of rice, sugar or petrol rose forever, the small investor would complain bitterly. Yet he seems to think it perfectly fair that share prices should go up forever, and very unfair if share prices crash. How greedy and hypocritical humans are! Consider the current moaning over the stock market crash.

The fall of the sensex from 12,624 to 10,400 represents a sharp 20% decline within two weeks. But few people seem to remember that sensex was at just 9,390 at the start of 2006. So, even after the crash last Monday, the sensex was still up 10.5% since the start of the year. No bonds or fixed deposits could give such a high return within five months. This point escapes the CPI(M), which sees the market crash as reason enough to stop pension funds from investing in equities.

Remember that the sensex was around 5,000 during the last general election in 2004. It then slumped to 4,282 on panic selling. From that low point, the sensex tripled in two years to 12,624 on May 10, 2006. That has been a bonanza, fuelling speculative frenzy. So, the 20% correction is to be welcomed. Stock market valuations remained stretched by historical standards, though not by developed market standards.

If the sensex falls all the way to the 9.390 level at the start of the year, the market would still have yielded enormous gains to investors since 2004. The long run prospects of the economy are excellent. So, some investor exuberance is understandable. Yet such exuberance needs to be tempered by sharp corrections from time to time. This sends the valuable message that exuberance is no substitute for judgement.

Govt helps calm roiled markets

Mumbai: After three days of sharp decline and volatility, Tuesday’s market provided a welcome break for investors. When trading opened in the morning, there was sharp volatility as the sensex dropped by nearly 300 points. That’s when local institutions stepped up their buying to cushion the recent crash that had shaved nearly 17% off the sensex. As a result, the index rallied with the afternoon trade to close 341 points higher at 10,823.

Meanwhile, during the day, the finance minister also made a statement in the Rajya Sabha to assure members there that the government was doing its bit to restore confidence among investors and bring back order in the marketplace.

P Chidambaram attributed the sharp volatility largely to a technical correction in the domestic market, a sense of uncertainty across global markets, and the inability of some large, highly leveraged traders to meet their obligations. He said the banks were providing ample liquidity to meet the margin obligations of these highly leveraged traders. “Therefore, in view of the fact that calm has returned to the market my advice to genuine long-term investors is to stay invested,’’ Chidambaram said.

Market players said that to some extent these steps had assured investors and a relative calm had been restored. Compared to Monday’s 1,315 point swing in the sensex, it gyrated just 674 points on Tuesday. Against a 17.3% loss in the three previous sessions it gained 3.3% during the day. And compared to a Rs 5.3 lakh crore loss in investors’ wealth in three earlier sessions, they were now richer by nearly Rs 1 lakh crore.

The ferocity of the crash in the last few days, however, has made market players extremely cautious and most are following a waitand-watch policy. “Should the index (sensex) go up by another 500 points, the strength of the market will be put to test,’’ said Manish Kanchan, CEO, Ambit Capital. Any fresh buying or renewed selling at that point would determine the robustness of the index, he said.

Behind Tuesday’s seemingly government-directed buying by Life Insurance Corporation, select state-run banks and mutual funds, there are signs that the day’s trading could just be a breather for the crashing sensex, market players said. On Tuesday, while domestic institutions were buying, foreign funds were heavy sellers, clocking a net outflow figure of over Rs 1,100 crore. Even retail investors are selling at every rise in stock prices. “The undertone is still very weak. Selling is seen at every small rally,’’ said the head of a local brokerage.

Another reason for the market’s pessimism with the day’s recovery was the comparatively low turnover. Compared to the average daily volumes of about Rs 4,200 crore on the BSE, it was just Rs 2,800 crore. What this means is that large players weren’t willing to buy and hence the turnover was low. Unless the index rises were accompanied by higher turnover, the recovery would not continue for long, a dealer with a local brokerage said.

STORM AND AFTER

- LIC continued its buying spree, supported by mutual funds and select banks, cushioning any fall during morning trades, foreign funds were big sellers.

- By the end of the day, they were net sellers to the tune of Rs 1,132 cr.

- Speculative buying pushed up sensex towards the end of session

- Inside parliament, the FM once again assured members that all steps were being taken to reduce volatility

IT’S "RAINING" SHARES

India’s economy is in the pink of health. The financial year 2005-06, saw it grow by 8.1 per cent. India Inc. has witnessed a similar growth.The Sensex, during the same time period, delivered a return of 70.78 per cent.This has led to several companies making ‘bonus issues’ and ‘stock split’ announcements. The calendar year 2005, witnessed 210 stock splits and 94 bonus issues. The current year (i.e. till May 5, 2006), has already observed 26 bonus issues and 46 stock splits.

READING INTO BONUS ISSUES

A bonus issue is the issue of additional equity shares by a company to its existing equity shareholders, at no cost to the shareholder. These shares are proportionately distributed in ratios, like 1:1 or 2:1, symbolising the proportion of your share holding and the bonus due to you.

RATIONALE FOR BONUS ISSUES

Reward Shareholders: The managements of profit-making companies opine that allotting bonus shares to shareholders is a method of distributing the profits to the shareholders as a reward for their belief in the company. Attract

Investments: A bonus issue sends a signal to the market that the company has been performing well and is confident that it can maintain its level of profitability in the future.

Peer Pressure: A company may feel pressured to announce a bonus issue if its competitor announces one.

GETTING A GRIP ON STOCK SPLITS

In a stock split, the face value of the existing shares is reduced in order to create fresh equity. There is no new equity issued.

RATIONALE FOR STOCK SPLITS

To change investor perceptions: There is a tendency for investors to consider a ‘high priced’ stock as expensive. Accordingly, companies whose share prices have risen to very high levels usually resort to stock splits, to artificially reduce their share price and attract a larger number of investors and thereby increase the liquidity of the stock. This corporate action will also make the company appear more attractively priced vis-à-vis its peers.

ELIGIBILITY

To be eligible for either of the two above-mentioned corporate actions, your name must appear in the company’s book on the ‘record date’. The record date is the date beyond which if your name appears in the company’s book, you will not be the beneficiary of the corporate action.

IMPACT OF THE ACTION

On the company’s share price: Immediately after the announcement of a bonus issue or a stock split, generally the share price increases. This rise is more pronounced in the case of a bonus issue than a stock split. Theoretically, after the record date, the price will fall to the extent of the ratio of the bonus issue or the stock split. However, in most cases, it has been observed that the fall is much less.This is because the share price depends on market sentiments, economic factors and the demand/ supply of the stock.

On retail investors: Investors can take advantage of the upward trend that a stock price witnesses when an announcement of a bonus issue or a stock split is made. When the share price falls after the record date,the investors will enjoy the added advantage of the increased liquidity that the stock will now enjoy.

On the overall stock market:Both these corporate actions would lead to a larger participation by all types of investor groups in the shares of the underlying company.

TAX IMPLICATIONS

Cost of shares: In the case of a bonus issue, the cost of the share is taken as nil. In the case of a stock split, the cost is proportionately divided between the original shares and the new shares in the ratio of the split. For instance, if the stock split is 1:1 and you have incurred a cost of Rs 100 per share (on the original share), the cost of the original share will now stand at Rs 50 and the cost of the new share you have received due to the split will be Rs 50.

Holding period of the shares: In case of equity, if you have held on to your shares for more than 12 months before selling, the profit is termed as long-term capital gain. If you have held on to your share for less than 12 months before sale, the profit earned is termed as shortterm capital gain. Presently, long-term capital gains on equity are tax exempt while short-term capital gains attract a flat tax rate of 10 per cent (+ education cess of 2 per cent + surcharge of 10 per cent, if applicable to you). In case of a bonus issue, the holding period of the bonus issue is taken from the date of allotment of bonus. In case of a stock split, the holding period is considered from the time of purchase of the original shares.

THE WAY FORWARD

Opt for a company which regularly announces bonus issues. However, it is imperative that the company should be financially sound, consistently record increasing profits, has a capable management and future potential. In the case of a stock split, do not be fooled into thinking that the stock is now available at a cheaper price. Remember that it is a psychological tool that the management uses to artificially reduce the stock price, and does not indicate the company’s profitability or future growth potential.

Sensex scales new peak, closes above 12620...

Shrugging off the weak trend in Asian indices, the Sensex sailed in positive territory throughout the trading session on strong bullish sentiment and traded above the 12600 mark for a major portion of the day.

The breadth of the market was positive. Of the 2,646 stocks traded on the BSE 1,677 stocks advanced, 914 stocks declined and 55 stocks ended unchanged. Out of 11 sectoral indices on the BSE, eight indices ended in positive territory. The BSE Bankex ended firm with gains of 2.49% at 5809 while the BSE Metal index rose 2.21% at 11239. The BSE Oil & Gas index added 1.79% at 6394. However, the BSE Auto index, the BSE FMCG index and the BSE HC index ended weak.

Movers & Shakers

Reliance Natural Resources, which got the board’s nod to raise $300 million via FCCBs, ended in the green.

Zicom Electronic Security Systems notched up gains on reports of the launch of "ZlCOMhome", a sophisticated security system for homes in India.

JB Chemicals & Pharmaceuticals moved up on reporting a 35% increase in its Q4FY2006 net profit at Rs15.45 crore as compared to Rs11.44 crore for the quarter ended March 31, 2005.

Scandent Solutions, which announced the success of the first society for worldwide interbank financial telecommunication service bureau that supplies secure messaging services and interface software to financial entities worldwide, came under selling pressure.

Sector Performance - Telecom

- The launch of the various pre-paid schemes of low denomination and longer validation period, an aggressive expansion in the B and C category cities and the falling prices of handsets continued to drive the explosive growth in the subscriber base during the fourth quarter.

- During Q4FY2006 Bharti Tele-Ventures added more than 2.5 million subscribers. Expect the company to report a 42% growth in its net profit yoy, as its margins are likely to improve on the back of the success of its

"Lifetime free incoming" offer.

Sector Performance - Pharma

- This quarter will see a good improvement in the revenues and profit margins of various pharmaceutical majors as compared with their performance in Q4FY2005. That is because the domestic demand picked up in this quarter; in the same quarter in the previous year the domestic revenues of these companies had declined sharply as a result of de-stocking due to the implementation of VAT. Apart from this, the cost-cutting methods employed by various companies may also result in higher margins. The price erosion in the US markets continues but some of the big pharma firms like Ranbaxy

Laboratories and Lupin are expected to benefit from the increasing generic opportunities in FY2007 as blockbuster drugs like Pravastatin and Simvastatin go generic during the year. - For this quarter Cipla is expected to show a 28% growth in its net profit yoy. The growth would be driven primarily by the improvement in its domestic formulation business, a possible increase in the other operating

revenues and increased bulk drug exports due to the supply of new drugs to its partners in the regulated markets. - Cadila Healthcare is expected to show a substantial growth of 60% in the bottom line to Rs35.5 crore due to higher margins driven by increased domestic formulation sales and exports to the regulated markets.

- Unichem Laboratories, which is primarily a formulation maker, is also expected to benefit from the rising domestic demand and may show close to 30% growth in its net profit.

- For this quarter, Lupin is expected to show a strong growth in its profit after tax (PAT; over 80% yoy) due to a much better domestic demand for its goods and higher revenues from key molecules like Suprax in the regulated

markets as the flu season was in full swing during the quarter. - Ranbaxy Laboratories is also expected to show a 15% growth in its net profit due to better revenues from the Commonwealth of Independent States, Africa and Europe, and higher domestic formulation sales. Also lower costs due to lesser litigation costs, and stabilising research and development expenses are expected to bump up the margins sequentially.

- We expect Orchid Chemicals to show a steady 25% increase in its revenues led by the sale of the key cephalosporins in the US markets. We also expect its PAT to increase by more than 40% yoy (despite a deferred tax write-back of Rs9.7 crore in Q4FY2005 that inflated the PAT to Rs16.6 crore in Q4FY2005).

Sector Performance - Oil & Gas

- The provisional numbers for FY2006 reported by Oil and Natural Gas Corporation show that the company is likely to post a 25% year-on-year drop in its profits for Q4FY2006. This is despite the fact that the crude prices have gone up substantially over Q4FY2006. The drop is mainly on account of a higher subsidy burden (the subsidy burden for the full year will be provided in the last quarter).

- RIL is expected to report a flat bottom line, as its refining margins for Q4FY2006 are likely to decline by $1 a barrel. However, sequentially the growth is likely to be around 23.6%, as the company had undertaken a

50-day planned shut-down in Q3FY2006.

Sector Performance - Metals

Non-ferrous

- Aluminum, copper and zinc prices created new highs in Q4FY2006, both in international and domestic markets. Also several price hikes were announced by the nonferrous metal companies during the quarter. These

developments should certainly have a positive impact on the Q4FY2006 performance of the non-ferrous companies. - Hindalco Industries raised aluminum prices by 16.2% or Rs17,000 per tonne in the quarter. The aluminium business saw a healthy volume growth on the back of a strong demand for the white metal. However, only a marginal recovery in copper production as compared with that in Q3FY2006 would offset the gains from the aluminum business and the company's earnings are expected to grow at 10.4%.

- Sterlite would benefit from an increased copper and aluminum production, higher TC/RC margins and excellent results from Hindustan Zinc. Its aluminum production business would benefit from the partial commissioning of the expanded part of the Korba facility.

- A strong demand for alumina coupled with supply shortages caused National Aluminium Company to revise its alumina prices by 16% during the quarter in line with the international prices. This coupled with a strong volume growth in its alumina and aluminum production business is likely to drive the OPM and profitability of the company in Q4FY2006.

- Zinc was the commodity in action during Q4FY2006. Hindustan Zinc raised zinc prices by 25.9% or Rs29,000 in the quarter. With a healthy growth in its realisations and volumes, the company should report the best growth in earnings.132%.among the entire metal pack.

- Ferrous metal companies were hurt by the overall uncertainty pervading in the international markets during the quarter which resulted in a sharp drop in the price of hot-rolled coils, sponge iron and pig iron. Respite came in March 2006 in the form of rising prices but the effect of the same will be felt only in Q1FY2007.

- Expect Tata Steel to end the quarter with a marginal drop of 3.4% in its profits. The benefit of higher metal production is likely to get negated by a lower average realisation in the quarter.

Sector Performance - Information Technology

- The average sequential revenue of the sector is estimated to grow at 6-10% in Q4FY2006 and the growth rate is marginally lower than that in the previous quarter but higher than the market's expectation at the beginning of the quarter. The average top line is expected to be driven by the 7-11% growth in the volumes (a higher sequential volume growth as Q3 has less number of working days) during the quarter.

- The appreciation of the rupee against all the other major currencies would adversely affect the sequential growth in the average revenue.

- Expect the revenue of Satyam Computer, HCL Technologies and Wipro to record a strong sequential growth of 8.5%, 9.6% and 10.2% respectively.

Sector Perfromance - FMCG

- Backed by a pick-up in the rural demand, FMCG sector has seen a gradual improvement in the volume growth every quarter. The revenue growth for the current quarter is likely to be in the higher double-digit range.

- Expect the earnings of the market leader, Hindustan Lever, to grow by 27% yoy backed by a strong volume growth and price hikes in key product segments.

- ITC's profits are expected to grow by a strong 33% yoy. Expect the growth to be broad based. ITC had recently effected price hikes in its cigarette business. Its non-FMCG businesses have also grown well.

- Expect Godrej Consumer Products to report a 20% revenue growth with its personal care segment continuing to record a strong growth. The net profit growth is likely to be in the 41% range as the vegetable oil prices have been stable and there has been a shift in the company's product mix in favour of the personal care products.

Sector Performance - Cement

- During Q4FY2006, the cement dispatches of all the three major players, Associated Cement Companies, Gujarat Ambuja Cement and the Aditya Birla Group, saw a handsome growth. The average price realisation also grew by a strong 8.6% in the quarter.

- Expect the cement division to be the top performer for Grasim Industries; however the poor performance of the viscose staple fibre and sponge iron businesses will drag down the profitability of the company.

- Expect Madras Cements Ltd (MCL) to register a healthy volume growth of 30% yoy in Q4FY2006 on the back of a strong demand in south India. With the elections round the corner, cement prices in the southern region declined by 3-4% yoy. However the implementation of the flat tax rate of 14.5% in Tamil Nadu as against the effective tax rate of 23% shall nullify the effect of the lower cement prices in the south. Consequently, expect MCL to register a strong 45% growth in its Q4FY2006 earnings.

- Shree Cement is likely to report a healthy volume growth of 11-12% driven by the commissioning of its new 1.2- million-tonne cement plant. This coupled with the impressive growth of 10-12% in the realisation is likely to lead to a high 50% growth in its operating profit.

Sector Performance - Capital Goods and Engineering

- The Index of Capital Goods grew by 16.8% for the year till January 2006 as compared with a growth of 13.1% in the same period last year. Considering the economy is witnessing a period of investment boom, expect a similar growth in the January-March 2006 period.

- Crompton Greaves should report a good performance in Q4FY2006 on the back of a strong order booking in the industrial system and power system divisions. Expect an improvement in the performance of its 100% subsidiary, Pauwels Transformers, during the quarter.

- In the wake of the receding input cost pressure, Thermax should continue with its margin expansion and report an improvement in its stand-alone operating profit margin (OPM). This coupled with a strong order booking should result in a healthy growth in its stand-alone earnings. We expect the loss-making subsidiary, ME Engineering, to show an improvement in its performance and drive the consolidated earnings of the company.

Sector Performance: Banking - Rising interest rates to hurt

- The loan book of scheduled commercial banks has grown by 33.3% during the quarter up to the week ended March 17, 2005. However, the growth in the net interest income (NII) is likely to be moderate. That is because the net interest margin is expected to be under pressure owing to a rise in the borrowing rates after the severe liquidity crunch of the fourth quarter.

The mark-to-market losses of the banks are also expected to go up, as the government bond yield has remained flat over the last quarter.- State Bank of India (SBI) is likely to report a decline in its NII as the margin pressure is likely to continue. The bank's borrowing cost is likely to go up in the wake of the redemption of the India Millennium Deposits in December 2005. Also in Q4FY2005, SBI had earned an interest income on the income tax refund which will result in a lower NII this quarter. The net profit growth is likely to be flat as the other income is also expected to be lower due to a lower income from the government business.

- ICICI Bank is likely to report a strong growth in its NII backed by a strong loan growth. The equity issuance by the bank in the last quarter should help it to achieve a robust growth in its loan book.

Sector Performance: Automobiles - Two-wheelers to outperform

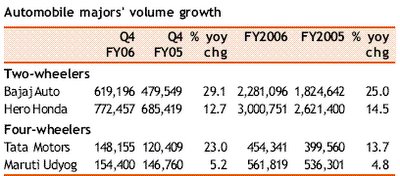

- The two-wheeler segment continues to outperform the four-wheeler segment in terms of volume growth.

- Among the two-wheelers, Bajaj Auto leads the sector with a 29.1% growth for Q4FY2006 and a 25% growth for FY2006. The growth has picked up strongly in Q4FY2006 after a subdued Q3FY2006.

- The four-wheeler segment, mainly the passenger vehicle segment, has been growing selectively. The growth in the volume of the segment leader, M-800, has been declining of late and is expected to be lower for the quarter, thereby putting a damper on the segment's growth. However, the decline in the sales of Maruti Udyog's M-800 model is expected to be offset by the pick-up in the offtake of Alto and Swift. The increased proportion of these higher-end models is expected to result in higher realisations and margins.

- The margins will be maintained during the quarter for both the segments, as the high prices of non-ferrous metals will be set off by the lower steel prices.

- The commercial vehicle segment has managed to maintain a double-digit growth rate on a high base of last year and this growth rate is expected to be maintained for the rest of the year.

Q4FY2006 Earnings Preview

- The domestic demand-driven story is likely to continue considering that the growth in the earnings of the Sensex is expected to have been led by companies from the automobile, cement, capital goods and fast moving consumer goods (FMCG) sectors in Q4FY2006.

- Pharmaceutical companies are also expected to show arobust growth for this quarter, since for these companies the growth in the same quarter last year was affectedby value-added tax (VAT) related issues.

- For the fourth quarter, the earnings growth rate of theSensex companies is likely to be 14.0% year on year(yoy), slightly lower than the growth rate of 14.3% inQ3FY2006.

- The lower growth can be attributed primarilyto the expectations of a flat growth in the bottom lineof Reliance Industries Ltd (RIL).

The FY2006 earnings of the Sensex companies areexpected to grow at 21.5%. Excluding the oil companies(RIL and Oil and Natural Gas Corporation) the growth islikely to be 22.6% for the quarter.

I will, in the subsequent posts, discuss performance of each sector.

Stock Reco's for Upcoming Week

Maruti Udyog

Recommendation: Hold

Price target: Under review

CMP: Rs 870

- Owning all of MSAILMaruti Udyog Ltd (MUL) would be buying out the entire stake of its joint venture partner, Suzuki Motor Company, Japan (SMC), in Maruti Suzuki Automobile India Ltd (MSAIL) and merging the subsidiary with itself.

- At present, MUL holds a 70% stake in MSAIL whereas SMC holds the remaining 30%. We view MUL’s decision to buy out the entire SMC stake in MSAIL as a big positive for the domestic car major.

Reliance Industries

Recommendation: Buy

Price target: Rs 870

CMP: Rs 847

- I had mentioned earlier that the forthcoming initial public offering of its subsidiary Reliance Petroleum will add an upside of approximately Rs75 per share to RIL’s value.

- The recent stake sale by RIL to global oil and gas major Chevron just vindicates our view.

Monetary policy review

- The RBI increased the benchmark repo and reverse repo rates in two consecutive moves during the last two quarterly reviews. In the forthcoming policy statement the RBI will have to strike a balance between the tightening liquidity and the surging oil prices as well as the rising asset inflation.

- We do not expect the RBI to tinker with the cash reserve ratio (CRR) as the liquidity situation is easing out. Nevertheless the same may be taken up in the quarterly review of the policy some time in July 2006.

- The RBI may announce some more safety measures in relation to the banking sector’s exposure to the capital market and the real estate sector.

- The central bank’s inflation guidance for FY2007 is likely to remain at 5.0-5.5%.

Stock Reco's for This Week

Target Price = Rs 912

- Godrej Consumer Products Ltd (GCPL) is a big beneficiary of the expected consumption boom in India. A rising proportion of the middle-income families will translate into a strong demand for its products like soaps, hair

colours and toiletries. - The market share gains in the soap business through the consolidation of brands (Godrej No 1) and the launch of new products will lead to a robust growth, outpacing the growth in the soap market.

- The hair colour segment offers huge opportunity owing to its under-penetration and a strong 16-20% compounded annual growth rate (CAGR). GCPL with its dominant market share and a quality product basket should reap handsome gains.

- Cash flows are expected to grow at a CAGR of 22% in the FY2005-08 period; the same will be deployed in purchasing growth by augmenting capacities and through inorganic growth aspirations.

- GCPL trades at a PER of 31.7x its FY2007E earnings in view of the inorganic growth triggers and the shareholders' value maximising strategy.

Satyam Computers

Target Price = Rs 900

- Unlike some of its front-line peers, Satyam has shown a healthy and consistent sequential growth over the past six to eight quarters.

- Despite the continued losses of its subsidiaries and the other cost pressures, the company.s top line growth has been accompanied by stability in profitability.

- It has levers to support its profitability like the turn-around in its subsidiaries, the broadening employee base, an increasing offshore contribution etc which would limit any downside to its profitability.

- It is ahead of some of its peers in terms of bagging business in the recently announced large outsourcing deals.

- It trades at attractive valuations of 20.7x its FY2007E earnings, which is still at a considerable discount to some of its peers.

ITC

Target Price = Rs 220

- ITC is the undisputed market leader in the cigarette business in India. Over the years ITC has gained substantial pricing power in the market and has been posting a good volume growth in the business.

- ITC has diversified its revenue stream by successfully channelising the huge cash flows generated from the cigarette business into new and upcoming businesses like hotels, fast moving consumer goods (FMCG), paperboards and agri-marketing.

- ITC's huge investment in these businesses has now started reflecting in a robust growth in the revenues as the profits.

- ITC's venture into agri-marketing through e-Choupal is now set to replicate the urban mall mania in rural areas through Choupal Sagar. Choupal Sagar is expected to be a major revenue and profit driver for ITC over the long term.

- With an earnings CAGR of 23.4% over FY2005-07E the stock is attractively quoting at a PER of 28.3x its FY2007E earnings.

Stock Reco's for this Week

Target Price = Rs 3500

- With the help of new product launches over the last few years, Bajaj Auto Ltd (BAL) is well poised to take advantage of the secular growth in the two-wheeler market. BAL is likely to consolidate its position in the market further as the new product launches continue.

- The three-wheeler segment, which is a high-margin business, is turning around after a brief lull. The changes in the regulatory regime in favour of vehicles using cleaner fuel is likely to boost the demand for threewheelers

where BAL is the undisputed leader. - With the increased contribution of high-margin vehicles and the softening of the prices of steel, BAL is expected to see a 20% compounded annual growth in its earnings over FY2005-07E.

- The stock is currently quoting at a PER of 19.8x its FY2007E earnings. The investment on the company.s books (Rs 648 per share) and the insurance subsidiaries (Rs 920 per share) add substantial value to BAL.s fair value.

BHEL

Target Price = Rs 2650

- Bharat Heavy Electricals Ltd (BHEL), a leading supplier of power equipment, will be the prime beneficiary of a four-fold increase in the investments (Rs 500,000 crore in the 11th Five-Year Plan as against Rs 112,000 crore in

the 9th Five-Year Plan) being made in the power sector. . - BHEL's current order book of Rs 37,500 crore, ie 3.0x its FY2005 revenue, provides high earnings visibility.

- The power ministry has proposed around five ultra mega power projects entailing a capacity addition of 20,000MW (4,000MW x 5) with the combined turnkey value of at least Rs 80,000 crore.

- BHEL.s recent technology transfer agreement with Alstom for design and manufacture of large-sized (500MW+) super-critical boilers will enable it to bid for the ultra mega power projects. I expect BHEL to bag a fair share out of this huge Rs 80,000-crore potential investment, which in turn will maintain the growth momentum in the company.s order book.

- The stock trades at a PER of 21.4x its FY2007E earnings. BHEL's valuation looks attractive as compared with that of its peers, such as Siemens, ABB and Larsen and Toubro.

TOP PICKS & PERFORMANCE OF MY RECOMMENDATIONS

Stock Reco's for Today...

Recommendation: Book profit

CMP = Rs 1,413

- The stock has appreciated by 28% since then and close to our price target of Rs1,450. We recommend investors to book profit.

Emco

Recommendation: Book profitCMP = Rs 800

- The stock has appreciated by 131.8% since then and achieved our price target of Rs600. We recommend investors to book profit.

Stock Reco's for Today...

Madras Cement

Recommendation: Buy

CMP = Rs 2388

Price target: Rs 3,250

- At the current market price of Rs2,388 the stock is discounting its F2007 earnings by 21x and its FY2008 earnings by 15.7x.

- The stock is trading at attractive valuations on EV/tonne basis with a value of US$116 for FY2007 and of US$109 for FY2008.

- At this price target the stock will be discounting its FY2008 EBIDTA by 11x and will be trading at EV/tonne of US$146.

McDowell & Company

Recommendation: Book Profit

CMP = Rs 878

- The stock has appreciated by 86% since then and achieved our price target of Rs750. We recommend investors to book profit.

Stock Reco's for Today...

Recommendation: Buy

CMP = Rs 704

Price target: Rs 850

- At the current market price of Rs704, UltraTech Cement is discounting its FY2008 earnings by 26.8x and 11.8x its FY2008 earnings before interest, depreciation, tax and amortisation (EBIDTA).

- On an EV/tonne basis the stock is trading at an attractive valuation of US$118 per tonne of cement. This is a huge discount to its peers like ACC and Gujarat Ambuja that are trading at valuations in excess of US$150 per tonne of cement.

- I believe the valuations are very attractive considering the company’s high leverage to the prices of cement. Consequently, we are revising our price target for the stock to Rs850, at which it will be trading at US$140 per tonne of cement, which is still a discount to the valuations commanded by its peers.

Jaiprakash Associates

Recommendation: BuyCMP = Rs 480

Price target: Rs 650

- At the current market price of Rs480, Jaiprakash Associates is discounting its FY2007 earnings by 21.1x and its FY2007 EBIDTA by 7.6x.

- I have valued the company on the sum-of-parts basis. I have valued the cement business at the rate of US$140 per tonne of cement and the Engineering & Construction business at a multiple of 7 on FY2008 EBIDTA. Consequently we are revising our target for JAL to Rs650.

Stock Recommendations for Today...

Recommendation: Buy

CMP = Rs 569

Price target: Rs 635

Godrej Consumer Products

Recommendation: Buy

CMP = Rs 760

Price target: Rs 912

- The visibility in the revenues and earnings has been the strongest in the recent years for the fast moving consumer goods (FMCG) industry in general and for Godrej Consumer Products in particular.

- The demand outlook is strong in view of the new breed of consumers ie semi-urban and rural consumers who have joined the consumption fray and have given the much needed spark to the industry.

- Given these vital fundamental changes, the valuations are fast changing. Comparable companies in the FMCG sector are already commanding higher valuations with the 2-year average industry price/earnings (P/E) multiple reaching +24-25x. GCPL, which trades at P/E multiple of 20.8x FY2008E consolidated earnings is still available at a discount of 20% to the average industry P/E.

- Considering the significant room for growth within the core businesses (hair care and toiletries businesses) and the entry in the international space through Keyline Brands, we have confidence in GCPL's long-term growth prospects.

- I am revising our price target for GCPL to Rs912, at which price the stock will discount its FY2008E consolidated earnings by 25x, in line with the industry.

Micro Tech: BUY

- Micro Technologies is products focused IT company that develops applications around mobile messaging and Internet.

- Over the years it has developed more than 80 products in various domains with micro vehicle black box, VBB, a vehicle security system, and micro home security system, HSS, messaging based security products being the most popular ones.

Robust order book

- The company's order book for its security products like the VBB and HSS has been growing over the past few quarters and currently it has orders to supply more than 0.35 million systems over the next eight quarters.

- I believe the order book would increase, going forward, as the company enters newer geographies and signs on more customers.

Valuations

- Micro Technologies has no direct comparables in the listed space. Therefore, we have valued this company on the average of FY07E PER of other small/mid cap IT companies.

- Based on this, I arrive at target price of Rs 412, an upside of 57.2% from the current level. The target price of Rs 412 is based on a PER of 14.4X that is the average FY07E PER of Indian IT companies with revenues of up to USD 100 million."

RALLIS INDIA - BUY

Capital infusion from the group by way of preference capital has helped the company make progress on its debt restructuring programme, with interest costs cut by nearly half over the past couple of years. With more cash being released by recent exits from non-core businesses, there appears to be further scope for interest cost savings from a continuation of debt restructuring efforts.

After registering a robust 80 per cent growth in post-tax profit on the back of a 15 per cent sales growth in the first half of this fiscal, Rallis has received a sharp setback to both revenues and profit in the December quarter.

However, investors in agrochemical stocks have to be prepared for volatile earnings as they depend on only on the state of agricultural output, but also on pest incidence in a particular season, which is always a wild card.

However, the modest valuation multiple enjoyed by the Rallis India stock may make it more resilient to downside.

UCO Bank: Buy

UCO Bank: BUY

Fresh investments can be considered in the stock of UCO Bank. The stock trades at a price-to-book value of slightly below one. This appears attractive when compared to its peers such as Syndicate Bank, Andhra Bank and Indian Overseas Bank that are quoting a price-to-book multiple of more than about 1.5.

The bank has done remarkably well on several vital business parameters over the last few months. Advances, for the quarter ended December 2005 have clocked a growth of over 45 per cent, outpacing the industry average of about 30 per cent. There is also improvement on the bad loans front.

The valuation of UCO Bank has, however, lagged behind its peers ever since the stock was listed. There are, however, good reasons for the discount. UCO Bank has for long been suffering from low margins, which impacted its profitability. This situation has continued this year also.

Net interest income rose only by about eight per cent in the December quarter even as advances growth was impressive. This is where the initiative to raise long-term debt fits in. The increased leverage will help in improving the profitability for shareholders. In addition, the discount in valuation compared to peers is relatively higher than warranted as indicated by the dividend yield of 3.2 per cent.

There is also scope for improvement. The bank's increasing thrust on retail business would protect margins going forward. UCO Bank has taken several initiatives to improve its fee income too. Several initiatives rolled out by the bank on the technology front also promise growth in the medium term. An investment with a medium-term perspective can be considered.

Stock Reco's for forthecoming week - End of March...

Recommendation: Buy

CMP: Rs 58

Target Price: Rs 94

- Developing its oil assets: Selan Exploration Technology Ltd (SETL) aims to considerably ramp up its production through the development of its oil & gas fields. In the first phase, it has embarked on the development of ten oil producing wells in the Bakrol oil field which is estimated to increase the production by at least 500 barrel of oil per day (bpod) over the next 18-24 months.

- Consequently, its earnings are estimated to grow at a CAGR of 39% over FY2006-09E. The first batch of the two additional wells is likely to come on stream by Q2FY2007.

- Relatively de-risked business model: Unlike its peers, SETL has not invested in exploratory blocks and all of its oil fields are located in the category I sedimentary basin that has a track record of proven commercial production. This means that it is not exposed to the inherent risk associated with the exploration business.

- Hike in promoter''s stake: Over the past five years, the promoters have gradually hiked their stake by 7.5% through a reduction in the equity capital from a buy-back of shares and an increase in the absolute number of shares held by them. This reflects the management''s confidence in the business.

- Attractive valuation: At an enterprise value (EV)/reserve of $0.7 per barrel of oil & oil equivalents (boe), the stock is trading at relatively much cheaper valuations as compared with the other domestic companies like Hindustan Oil Exploration Company (HOEC) and Oil and Natural Gas Corporation (ONGC).

- Globally, exploration and production (E&P) companies command a valuation in excess of $7-8 per boe of the estimated proven and probable (2P) reserve. The stock is expected to get re-rated with the commercialisation of additional wells and ramp-up in the production.

- I recommend a Buy call on the stock with a price target of Rs94 (based on EV/reserve of $1.1/boe which is at a 75% discount to the prevailing valuations of HOEC).

Stock Reco's for the forthcoming week - End of March...

Cadila Healthcare Ltd

Recommendation: Buy

CMP: Rs 595.00

Target Price: Rs 850

- US generic business to grow exponentially: Cadila Healthcare (Cadila) has made a big entry into the regulated markets of US formulations this year. In the coming years its revenues from the high-margin regulated markets are expected to increase exponentially.

- It has a strong research and product pipeline with 30 products expected to receive generic approval by FY2007.

- Strong and steady domestic formulation business to provide a solid base: Cadila is ranked number five in the domestic formulation business in India. It plans to introduce over 40 products in the Indian market in the next two years. We expect the formulation business to be a steady revenue source in the future, showing a higher-than-industry growth rate.

- Key subsidiaries to start adding value: Cadila has subsidiaries in France, the USA and Brazil, and these were making losses till this year. The French business, earlier expected to break even in FY2009, is now expected to do so even earlier, in FY2008.

- The US subsidiary is expected to earn good profits for Cadila from FY2007 onwards. I expect these subsidiaries to collectively make a profit of over Rs 32 crore in FY2008 as compared with a loss of over Rs 30 crore in FY2005.

- Buy with a price target of Rs 850: A strong research-based, integrated pharma player, Cadila is now spreading its wings to the high-margin regulated markets.

- I expect its consolidated profit after tax (PAT) to grow from Rs117.9 crore in FY2005 to Rs 293.8 crore in FY2008, at a 36% CAGR. Considering its strong growth prospects, we initiate our Buy recommendation on Cadila with a 12-month price target of Rs850, which is a 43% upside to the current market price of Rs595.

Stock Reco's for Friday, March 24

Recommendation: Book Profit

Current market price: Rs 181

- I had initiated coverage on Mahanagar Telephone Nigam on May 05, 2004 at a price of Rs 148.

- The stock has achieved our price target of Rs 170. We recommend investors to book profits.

Stocks to Watch in this Week

- Ratnamani Metals & Tubes has secured a order worth Rs 90 crore from a petrochemical company and two export orders worth Rs 30 crore from European companies.

- EID Parry India has entered into a 50:50 joint venture with Roca of Spain for parryware business.

- Reliance Industries is likely to raise about Rs660 crore though an overseas bond issue to fund the capex of its refining and petrochemicals businesses.

Selan Exploration Technology

Recommendation: Buy

CMP = Rs 58

Price target: Rs 94

- Developing its oil assets: Selan Exploration Technology Ltd (SETL) aims to considerably ramp up its production through the development of its oil & gas fields.

- In the first phase, it has embarked on the development of ten oil producing wells in the Bakrol oil field which is estimated to increase the production by at least 500 barrel of oil per day (bpod) over the next 18-24 months.

- Consequently, its earnings are estimated to grow at a CAGR of 39% over FY2006-09E. The first batch of the two additional wells is likely to come on stream by Q2FY2007.

- Relatively de-risked business model: Unlike its peers, SETL has not invested in exploratory blocks and all of its oil fields are located in the category I sedimentary basin that has a track record of proven commercial production. This means that it is not exposed to the inherent risk associated with the exploration business.

- Attractive valuation: At an enterprise value (EV)/reserve of $0.7 per barrel of oil & oil equivalents (boe), the stock is trading at relatively much cheaper valuations as compared with the other domestic companies like Hindustan Oil Exploration Company (HOEC) and Oil and Natural Gas Corporation (ONGC). Globally, exploration and production (E&P) companies command a valuation in excess of $7-8 per boe of the estimated proven and probable (2P) reserve.

- The stock is expected to get re-rated with the commercialisation of additional wells and ramp-up in the production. We recommend a Buy call on the stock with a price target of Rs94 (based on EV/reserve of $1.1/boe which is at a 75% discount to the prevailing valuations of HOEC).

Stock Reco's for This Week

Recommendation: Buy

CMP = Rs 138

Price target: Rs 194

- ORG Informatics has announced that it has bagged an order worth Rs 255 crore from Bharat Electronics Ltd (BEL) for the convergent billing system that is being implemented for the state-owned Mahanagar Telephone Nigam Ltd (MTNL).

- The order largely involves the supply and integration of the hardware related requirements of the project.

- Consequently, the margins are likely to be lower than the double-digit margins reported by the telecom business segment currently. The order is to be executed over the period of the next 24 months.

- Hence, the future of ORG Informatics over the next couple of months seem to be very bright and hence I recommend Buy option for this stock.