- The launch of the various pre-paid schemes of low denomination and longer validation period, an aggressive expansion in the B and C category cities and the falling prices of handsets continued to drive the explosive growth in the subscriber base during the fourth quarter.

- During Q4FY2006 Bharti Tele-Ventures added more than 2.5 million subscribers. Expect the company to report a 42% growth in its net profit yoy, as its margins are likely to improve on the back of the success of its

"Lifetime free incoming" offer.

Sector Performance - Telecom

Telecom: Explosive growth in subscriber base

Sector Performance - Pharma

Pharma: Overall improvement in revenues

- This quarter will see a good improvement in the revenues and profit margins of various pharmaceutical majors as compared with their performance in Q4FY2005. That is because the domestic demand picked up in this quarter; in the same quarter in the previous year the domestic revenues of these companies had declined sharply as a result of de-stocking due to the implementation of VAT. Apart from this, the cost-cutting methods employed by various companies may also result in higher margins. The price erosion in the US markets continues but some of the big pharma firms like Ranbaxy

Laboratories and Lupin are expected to benefit from the increasing generic opportunities in FY2007 as blockbuster drugs like Pravastatin and Simvastatin go generic during the year. - For this quarter Cipla is expected to show a 28% growth in its net profit yoy. The growth would be driven primarily by the improvement in its domestic formulation business, a possible increase in the other operating

revenues and increased bulk drug exports due to the supply of new drugs to its partners in the regulated markets. - Cadila Healthcare is expected to show a substantial growth of 60% in the bottom line to Rs35.5 crore due to higher margins driven by increased domestic formulation sales and exports to the regulated markets.

- Unichem Laboratories, which is primarily a formulation maker, is also expected to benefit from the rising domestic demand and may show close to 30% growth in its net profit.

- For this quarter, Lupin is expected to show a strong growth in its profit after tax (PAT; over 80% yoy) due to a much better domestic demand for its goods and higher revenues from key molecules like Suprax in the regulated

markets as the flu season was in full swing during the quarter. - Ranbaxy Laboratories is also expected to show a 15% growth in its net profit due to better revenues from the Commonwealth of Independent States, Africa and Europe, and higher domestic formulation sales. Also lower costs due to lesser litigation costs, and stabilising research and development expenses are expected to bump up the margins sequentially.

- We expect Orchid Chemicals to show a steady 25% increase in its revenues led by the sale of the key cephalosporins in the US markets. We also expect its PAT to increase by more than 40% yoy (despite a deferred tax write-back of Rs9.7 crore in Q4FY2005 that inflated the PAT to Rs16.6 crore in Q4FY2005).

Sector Performance - Oil & Gas

Oil and gas: Hit by higher subsidy burden

- The provisional numbers for FY2006 reported by Oil and Natural Gas Corporation show that the company is likely to post a 25% year-on-year drop in its profits for Q4FY2006. This is despite the fact that the crude prices have gone up substantially over Q4FY2006. The drop is mainly on account of a higher subsidy burden (the subsidy burden for the full year will be provided in the last quarter).

- RIL is expected to report a flat bottom line, as its refining margins for Q4FY2006 are likely to decline by $1 a barrel. However, sequentially the growth is likely to be around 23.6%, as the company had undertaken a

50-day planned shut-down in Q3FY2006.

Sector Performance - Metals

Metals: Non-ferrous metals shine, ferrous metals dull

Non-ferrous

Non-ferrous

- Aluminum, copper and zinc prices created new highs in Q4FY2006, both in international and domestic markets. Also several price hikes were announced by the nonferrous metal companies during the quarter. These

developments should certainly have a positive impact on the Q4FY2006 performance of the non-ferrous companies. - Hindalco Industries raised aluminum prices by 16.2% or Rs17,000 per tonne in the quarter. The aluminium business saw a healthy volume growth on the back of a strong demand for the white metal. However, only a marginal recovery in copper production as compared with that in Q3FY2006 would offset the gains from the aluminum business and the company's earnings are expected to grow at 10.4%.

- Sterlite would benefit from an increased copper and aluminum production, higher TC/RC margins and excellent results from Hindustan Zinc. Its aluminum production business would benefit from the partial commissioning of the expanded part of the Korba facility.

- A strong demand for alumina coupled with supply shortages caused National Aluminium Company to revise its alumina prices by 16% during the quarter in line with the international prices. This coupled with a strong volume growth in its alumina and aluminum production business is likely to drive the OPM and profitability of the company in Q4FY2006.

- Zinc was the commodity in action during Q4FY2006. Hindustan Zinc raised zinc prices by 25.9% or Rs29,000 in the quarter. With a healthy growth in its realisations and volumes, the company should report the best growth in earnings.132%.among the entire metal pack.

- Ferrous metal companies were hurt by the overall uncertainty pervading in the international markets during the quarter which resulted in a sharp drop in the price of hot-rolled coils, sponge iron and pig iron. Respite came in March 2006 in the form of rising prices but the effect of the same will be felt only in Q1FY2007.

- Expect Tata Steel to end the quarter with a marginal drop of 3.4% in its profits. The benefit of higher metal production is likely to get negated by a lower average realisation in the quarter.

Sector Performance - Information Technology

Information technology: Strong sequential growth in revenue

- The average sequential revenue of the sector is estimated to grow at 6-10% in Q4FY2006 and the growth rate is marginally lower than that in the previous quarter but higher than the market's expectation at the beginning of the quarter. The average top line is expected to be driven by the 7-11% growth in the volumes (a higher sequential volume growth as Q3 has less number of working days) during the quarter.

- The appreciation of the rupee against all the other major currencies would adversely affect the sequential growth in the average revenue.

- Expect the revenue of Satyam Computer, HCL Technologies and Wipro to record a strong sequential growth of 8.5%, 9.6% and 10.2% respectively.

Sector Perfromance - FMCG

FMCG: Volume growth continues

- Backed by a pick-up in the rural demand, FMCG sector has seen a gradual improvement in the volume growth every quarter. The revenue growth for the current quarter is likely to be in the higher double-digit range.

- Expect the earnings of the market leader, Hindustan Lever, to grow by 27% yoy backed by a strong volume growth and price hikes in key product segments.

- ITC's profits are expected to grow by a strong 33% yoy. Expect the growth to be broad based. ITC had recently effected price hikes in its cigarette business. Its non-FMCG businesses have also grown well.

- Expect Godrej Consumer Products to report a 20% revenue growth with its personal care segment continuing to record a strong growth. The net profit growth is likely to be in the 41% range as the vegetable oil prices have been stable and there has been a shift in the company's product mix in favour of the personal care products.

Sector Performance - Cement

Cement: Healthy growth in dispatches of top three

- During Q4FY2006, the cement dispatches of all the three major players, Associated Cement Companies, Gujarat Ambuja Cement and the Aditya Birla Group, saw a handsome growth. The average price realisation also grew by a strong 8.6% in the quarter.

- Expect the cement division to be the top performer for Grasim Industries; however the poor performance of the viscose staple fibre and sponge iron businesses will drag down the profitability of the company.

- Expect Madras Cements Ltd (MCL) to register a healthy volume growth of 30% yoy in Q4FY2006 on the back of a strong demand in south India. With the elections round the corner, cement prices in the southern region declined by 3-4% yoy. However the implementation of the flat tax rate of 14.5% in Tamil Nadu as against the effective tax rate of 23% shall nullify the effect of the lower cement prices in the south. Consequently, expect MCL to register a strong 45% growth in its Q4FY2006 earnings.

- Shree Cement is likely to report a healthy volume growth of 11-12% driven by the commissioning of its new 1.2- million-tonne cement plant. This coupled with the impressive growth of 10-12% in the realisation is likely to lead to a high 50% growth in its operating profit.

Sector Performance - Capital Goods and Engineering

Capital goods and engineering: Growth continues

- The Index of Capital Goods grew by 16.8% for the year till January 2006 as compared with a growth of 13.1% in the same period last year. Considering the economy is witnessing a period of investment boom, expect a similar growth in the January-March 2006 period.

- Crompton Greaves should report a good performance in Q4FY2006 on the back of a strong order booking in the industrial system and power system divisions. Expect an improvement in the performance of its 100% subsidiary, Pauwels Transformers, during the quarter.

- In the wake of the receding input cost pressure, Thermax should continue with its margin expansion and report an improvement in its stand-alone operating profit margin (OPM). This coupled with a strong order booking should result in a healthy growth in its stand-alone earnings. We expect the loss-making subsidiary, ME Engineering, to show an improvement in its performance and drive the consolidated earnings of the company.

Sector Performance: Banking - Rising interest rates to hurt

BANKING Sector Performance

- The loan book of scheduled commercial banks has grown by 33.3% during the quarter up to the week ended March 17, 2005. However, the growth in the net interest income (NII) is likely to be moderate. That is because the net interest margin is expected to be under pressure owing to a rise in the borrowing rates after the severe liquidity crunch of the fourth quarter.

The mark-to-market losses of the banks are also expected to go up, as the government bond yield has remained flat over the last quarter.- State Bank of India (SBI) is likely to report a decline in its NII as the margin pressure is likely to continue. The bank's borrowing cost is likely to go up in the wake of the redemption of the India Millennium Deposits in December 2005. Also in Q4FY2005, SBI had earned an interest income on the income tax refund which will result in a lower NII this quarter. The net profit growth is likely to be flat as the other income is also expected to be lower due to a lower income from the government business.

- ICICI Bank is likely to report a strong growth in its NII backed by a strong loan growth. The equity issuance by the bank in the last quarter should help it to achieve a robust growth in its loan book.

Sector Performance: Automobiles - Two-wheelers to outperform

AUTOMOBILES Sector Performance

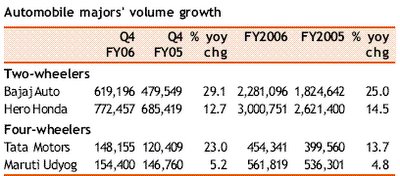

- The two-wheeler segment continues to outperform the four-wheeler segment in terms of volume growth.

- Among the two-wheelers, Bajaj Auto leads the sector with a 29.1% growth for Q4FY2006 and a 25% growth for FY2006. The growth has picked up strongly in Q4FY2006 after a subdued Q3FY2006.

- The four-wheeler segment, mainly the passenger vehicle segment, has been growing selectively. The growth in the volume of the segment leader, M-800, has been declining of late and is expected to be lower for the quarter, thereby putting a damper on the segment's growth. However, the decline in the sales of Maruti Udyog's M-800 model is expected to be offset by the pick-up in the offtake of Alto and Swift. The increased proportion of these higher-end models is expected to result in higher realisations and margins.

- The margins will be maintained during the quarter for both the segments, as the high prices of non-ferrous metals will be set off by the lower steel prices.

- The commercial vehicle segment has managed to maintain a double-digit growth rate on a high base of last year and this growth rate is expected to be maintained for the rest of the year.

Q4FY2006 Earnings Preview

Key points

- The domestic demand-driven story is likely to continue considering that the growth in the earnings of the Sensex is expected to have been led by companies from the automobile, cement, capital goods and fast moving consumer goods (FMCG) sectors in Q4FY2006.

- Pharmaceutical companies are also expected to show arobust growth for this quarter, since for these companies the growth in the same quarter last year was affectedby value-added tax (VAT) related issues.

- For the fourth quarter, the earnings growth rate of theSensex companies is likely to be 14.0% year on year(yoy), slightly lower than the growth rate of 14.3% inQ3FY2006.

- The lower growth can be attributed primarilyto the expectations of a flat growth in the bottom lineof Reliance Industries Ltd (RIL).

The FY2006 earnings of the Sensex companies areexpected to grow at 21.5%. Excluding the oil companies(RIL and Oil and Natural Gas Corporation) the growth islikely to be 22.6% for the quarter.

I will, in the subsequent posts, discuss performance of each sector.

Stock Reco's for Upcoming Week

Maruti Udyog

Recommendation: Hold

Price target: Under review

CMP: Rs 870

- Owning all of MSAILMaruti Udyog Ltd (MUL) would be buying out the entire stake of its joint venture partner, Suzuki Motor Company, Japan (SMC), in Maruti Suzuki Automobile India Ltd (MSAIL) and merging the subsidiary with itself.

- At present, MUL holds a 70% stake in MSAIL whereas SMC holds the remaining 30%. We view MUL’s decision to buy out the entire SMC stake in MSAIL as a big positive for the domestic car major.

Reliance Industries

Recommendation: Buy

Price target: Rs 870

CMP: Rs 847

- I had mentioned earlier that the forthcoming initial public offering of its subsidiary Reliance Petroleum will add an upside of approximately Rs75 per share to RIL’s value.

- The recent stake sale by RIL to global oil and gas major Chevron just vindicates our view.

Monetary policy review

The Reserve Bank of India (RBI) will announce the Monetary and Credit Policy statement for 2006-07 on April 18, 2006. We discuss below our expectations of the apex bank.

- The RBI increased the benchmark repo and reverse repo rates in two consecutive moves during the last two quarterly reviews. In the forthcoming policy statement the RBI will have to strike a balance between the tightening liquidity and the surging oil prices as well as the rising asset inflation.

- We do not expect the RBI to tinker with the cash reserve ratio (CRR) as the liquidity situation is easing out. Nevertheless the same may be taken up in the quarterly review of the policy some time in July 2006.

- The RBI may announce some more safety measures in relation to the banking sector’s exposure to the capital market and the real estate sector.

- The central bank’s inflation guidance for FY2007 is likely to remain at 5.0-5.5%.

Stock Reco's for This Week

Godrej Consumer

Target Price = Rs 912

Satyam Computers

Target Price = Rs 900

ITC

Target Price = Rs 220

Target Price = Rs 912

- Godrej Consumer Products Ltd (GCPL) is a big beneficiary of the expected consumption boom in India. A rising proportion of the middle-income families will translate into a strong demand for its products like soaps, hair

colours and toiletries. - The market share gains in the soap business through the consolidation of brands (Godrej No 1) and the launch of new products will lead to a robust growth, outpacing the growth in the soap market.

- The hair colour segment offers huge opportunity owing to its under-penetration and a strong 16-20% compounded annual growth rate (CAGR). GCPL with its dominant market share and a quality product basket should reap handsome gains.

- Cash flows are expected to grow at a CAGR of 22% in the FY2005-08 period; the same will be deployed in purchasing growth by augmenting capacities and through inorganic growth aspirations.

- GCPL trades at a PER of 31.7x its FY2007E earnings in view of the inorganic growth triggers and the shareholders' value maximising strategy.

Satyam Computers

Target Price = Rs 900

- Unlike some of its front-line peers, Satyam has shown a healthy and consistent sequential growth over the past six to eight quarters.

- Despite the continued losses of its subsidiaries and the other cost pressures, the company.s top line growth has been accompanied by stability in profitability.

- It has levers to support its profitability like the turn-around in its subsidiaries, the broadening employee base, an increasing offshore contribution etc which would limit any downside to its profitability.

- It is ahead of some of its peers in terms of bagging business in the recently announced large outsourcing deals.

- It trades at attractive valuations of 20.7x its FY2007E earnings, which is still at a considerable discount to some of its peers.

ITC

Target Price = Rs 220

- ITC is the undisputed market leader in the cigarette business in India. Over the years ITC has gained substantial pricing power in the market and has been posting a good volume growth in the business.

- ITC has diversified its revenue stream by successfully channelising the huge cash flows generated from the cigarette business into new and upcoming businesses like hotels, fast moving consumer goods (FMCG), paperboards and agri-marketing.

- ITC's huge investment in these businesses has now started reflecting in a robust growth in the revenues as the profits.

- ITC's venture into agri-marketing through e-Choupal is now set to replicate the urban mall mania in rural areas through Choupal Sagar. Choupal Sagar is expected to be a major revenue and profit driver for ITC over the long term.

- With an earnings CAGR of 23.4% over FY2005-07E the stock is attractively quoting at a PER of 28.3x its FY2007E earnings.

Stock Reco's for this Week

Bajaj Auto

Target Price = Rs 3500

BHEL

Target Price = Rs 2650

Target Price = Rs 3500

- With the help of new product launches over the last few years, Bajaj Auto Ltd (BAL) is well poised to take advantage of the secular growth in the two-wheeler market. BAL is likely to consolidate its position in the market further as the new product launches continue.

- The three-wheeler segment, which is a high-margin business, is turning around after a brief lull. The changes in the regulatory regime in favour of vehicles using cleaner fuel is likely to boost the demand for threewheelers

where BAL is the undisputed leader. - With the increased contribution of high-margin vehicles and the softening of the prices of steel, BAL is expected to see a 20% compounded annual growth in its earnings over FY2005-07E.

- The stock is currently quoting at a PER of 19.8x its FY2007E earnings. The investment on the company.s books (Rs 648 per share) and the insurance subsidiaries (Rs 920 per share) add substantial value to BAL.s fair value.

BHEL

Target Price = Rs 2650

- Bharat Heavy Electricals Ltd (BHEL), a leading supplier of power equipment, will be the prime beneficiary of a four-fold increase in the investments (Rs 500,000 crore in the 11th Five-Year Plan as against Rs 112,000 crore in

the 9th Five-Year Plan) being made in the power sector. . - BHEL's current order book of Rs 37,500 crore, ie 3.0x its FY2005 revenue, provides high earnings visibility.

- The power ministry has proposed around five ultra mega power projects entailing a capacity addition of 20,000MW (4,000MW x 5) with the combined turnkey value of at least Rs 80,000 crore.

- BHEL.s recent technology transfer agreement with Alstom for design and manufacture of large-sized (500MW+) super-critical boilers will enable it to bid for the ultra mega power projects. I expect BHEL to bag a fair share out of this huge Rs 80,000-crore potential investment, which in turn will maintain the growth momentum in the company.s order book.

- The stock trades at a PER of 21.4x its FY2007E earnings. BHEL's valuation looks attractive as compared with that of its peers, such as Siemens, ABB and Larsen and Toubro.

TOP PICKS & PERFORMANCE OF MY RECOMMENDATIONS

Stock Reco's for Today...

Container Corporation of India

Recommendation: Book profit

CMP = Rs 1,413

CMP = Rs 800

Recommendation: Book profit

CMP = Rs 1,413

- The stock has appreciated by 28% since then and close to our price target of Rs1,450. We recommend investors to book profit.

Emco

Recommendation: Book profitCMP = Rs 800

- The stock has appreciated by 131.8% since then and achieved our price target of Rs600. We recommend investors to book profit.

Stock Reco's for Today...

Madras Cement

Recommendation: Buy

CMP = Rs 2388

Price target: Rs 3,250

- At the current market price of Rs2,388 the stock is discounting its F2007 earnings by 21x and its FY2008 earnings by 15.7x.

- The stock is trading at attractive valuations on EV/tonne basis with a value of US$116 for FY2007 and of US$109 for FY2008.

- At this price target the stock will be discounting its FY2008 EBIDTA by 11x and will be trading at EV/tonne of US$146.

McDowell & Company

Recommendation: Book Profit

CMP = Rs 878

- The stock has appreciated by 86% since then and achieved our price target of Rs750. We recommend investors to book profit.

Stock Reco's for Today...

UltraTech Cement

Recommendation: Buy

CMP = Rs 704

Price target: Rs 850

CMP = Rs 480

Price target: Rs 650

Recommendation: Buy

CMP = Rs 704

Price target: Rs 850

- At the current market price of Rs704, UltraTech Cement is discounting its FY2008 earnings by 26.8x and 11.8x its FY2008 earnings before interest, depreciation, tax and amortisation (EBIDTA).

- On an EV/tonne basis the stock is trading at an attractive valuation of US$118 per tonne of cement. This is a huge discount to its peers like ACC and Gujarat Ambuja that are trading at valuations in excess of US$150 per tonne of cement.

- I believe the valuations are very attractive considering the company’s high leverage to the prices of cement. Consequently, we are revising our price target for the stock to Rs850, at which it will be trading at US$140 per tonne of cement, which is still a discount to the valuations commanded by its peers.

Jaiprakash Associates

Recommendation: BuyCMP = Rs 480

Price target: Rs 650

- At the current market price of Rs480, Jaiprakash Associates is discounting its FY2007 earnings by 21.1x and its FY2007 EBIDTA by 7.6x.

- I have valued the company on the sum-of-parts basis. I have valued the cement business at the rate of US$140 per tonne of cement and the Engineering & Construction business at a multiple of 7 on FY2008 EBIDTA. Consequently we are revising our target for JAL to Rs650.

Stock Recommendations for Today...

Marico Industries

Recommendation: Buy

CMP = Rs 569

Price target: Rs 635

Godrej Consumer Products

Recommendation: Buy

CMP = Rs 760

Price target: Rs 912

Recommendation: Buy

CMP = Rs 569

Price target: Rs 635

Godrej Consumer Products

Recommendation: Buy

CMP = Rs 760

Price target: Rs 912

- The visibility in the revenues and earnings has been the strongest in the recent years for the fast moving consumer goods (FMCG) industry in general and for Godrej Consumer Products in particular.

- The demand outlook is strong in view of the new breed of consumers ie semi-urban and rural consumers who have joined the consumption fray and have given the much needed spark to the industry.

- Given these vital fundamental changes, the valuations are fast changing. Comparable companies in the FMCG sector are already commanding higher valuations with the 2-year average industry price/earnings (P/E) multiple reaching +24-25x. GCPL, which trades at P/E multiple of 20.8x FY2008E consolidated earnings is still available at a discount of 20% to the average industry P/E.

- Considering the significant room for growth within the core businesses (hair care and toiletries businesses) and the entry in the international space through Keyline Brands, we have confidence in GCPL's long-term growth prospects.

- I am revising our price target for GCPL to Rs912, at which price the stock will discount its FY2008E consolidated earnings by 25x, in line with the industry.

Subscribe to:

Comments (Atom)